Reduce Or Eliminate A Bad Habit

Take a quick look at your current spending habits. There can be many ways of adjusting your current habits to save hundreds of dollars each year which will allow you to add more into your savings account. If your guilty pleasure is online shopping, consider limiting how many purchases you make. Disengage from marketing emails to avoid seeing “deals” regularly. You can save money and avoid additional clutter in your home! Additionally, although eating out at restaurants or ordering take out can be delicious, it’s not so convenient for your wallet. Instead of ordering good, trying cooking a few meals at home each week.

Evaluate Career Opportunities

Changing or upgrading your job and earning a higher salary is a great way to help you save money for home purchase. Search current job listings online and compare base salaries to see earnings in similar occupations. Use these results to have a candid discussion with your employer about increasing your salary or finding alternate positions or promotions. If you don’t like your current job, consider searching for higher paid opportunities with other companies.

Start Reducing Your Debt

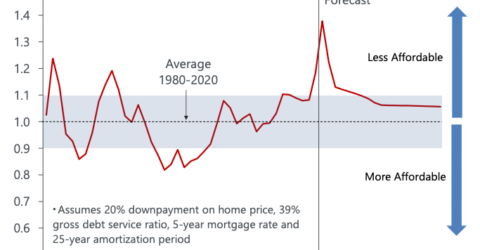

Diverting additional funds towards liabilities like debt may seem illogical if you’re trying to save for a home purchase. However, your debt to income ratio will be one of the first things that financial institutions consider when evaluating you for a home loan. Having more debt could result in higher interest payments and the need for a larger down payment. Before applying for a mortgage, you should consider taking some time to pay off your debts. Evaluate how much money you owe on things like your credit cards, student loans, bank and car loans, and devise a strategy to pay them off.

Combination Real Estate can easily assist you in finding the house of your dreams within your price range, allowing you to achieve your dreams sooner than you expected.